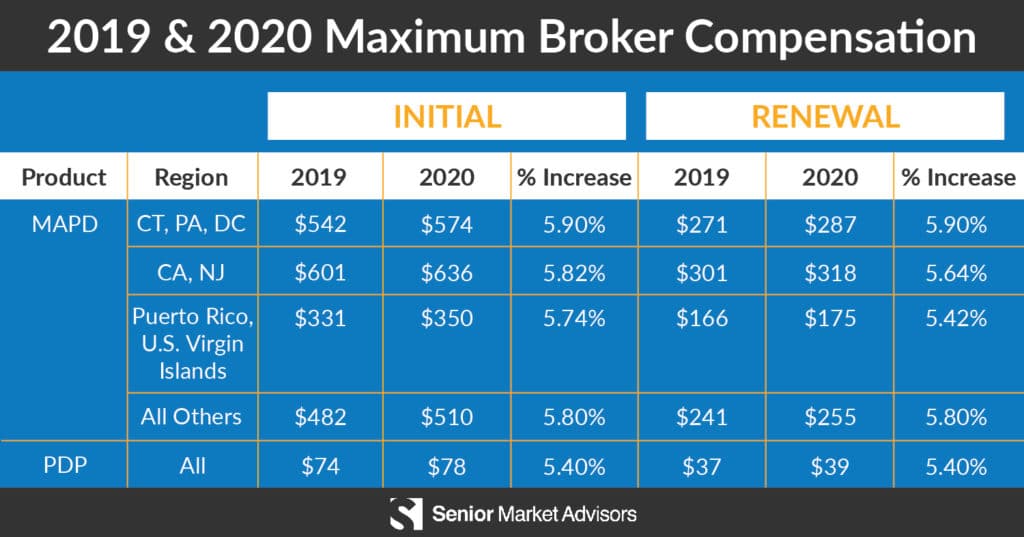

There is no reduction in compensation and you own your book. Using our program, lets assume an agent places 5 cases a month during insuranec Medicare SEP. Keep in mind, MAPD compensation is different by state. Click here for Medicare commissions by insurabce. We will also assume an agent writes 50 cases during AEP. There will also be Medicare supplement sales involved but to keep it simple we will stick with MAPD for the purposes of this example.

Commissions Depend on the Type of Life Insurance — Here’s What You Need to Know

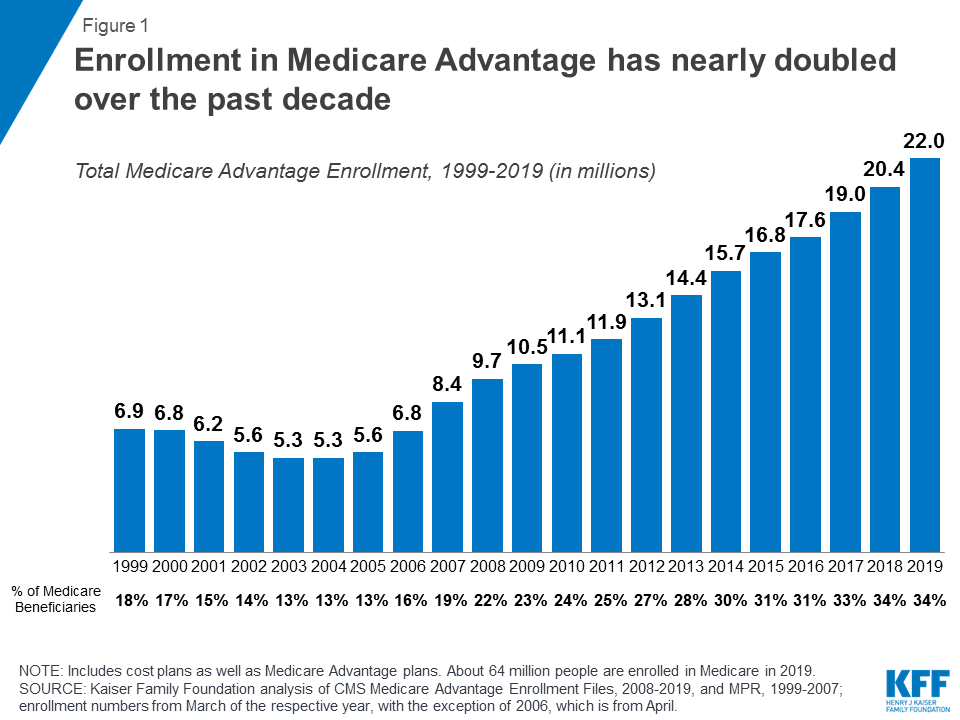

In fact, I started in the senior market selling Medicare Supplements and transitioned to cross selling other lines of business such as Medicare Advantage and ancillary lines such as dental, vision, cancer, and hospital indemnity products. The main reason I wrote this guide is to show you our team is dedicated to going above and beyond to ensure we always provide you value. I strongly believe every insurance agent needs a base of residual income in order to create long term sustainability. Selling Medicare can steadily help you build a six-figure residual income in as little as years. Most companies pay the same commission for seven years and some even pay for life. Plus, Medicare sales are at an all-time high because of the aging population. The U. Census says that by there will be about There is nothing worse than independent agents who think they can wing it.

Education Requirements

You start to learn how to sell Medicare Supplements through the government handbook: the Medicare and You Handbook. You can download a copy directly from Medicare , or go to your local Social Security office. I always tell anyone looking for Medicare supplement training to first read the Medicare and You Handbook cover to cover, and then read it again. You should do the same. Following are the basic elements of Medicare you will need to dig into the booklet to really understand how it works :. Want to learn how to get marketing reimbursements and reduce your overhead? Yes, I want to maximize my residual income. Selling Medicare supplements takes an enormous understanding of Medicare, so make sure and pay attention to the next few paragraphs as well as getting your copy of the Medicare and You handbook.

Payment from Initial Enrollment

Medicare Supplement commissions continue to be a good source of income as well. Generally agents receive half as much compensation for the following years. Usually, once you enroll a client in a plan, you receive the initial payment the first year. For each year after, if your client stays in that plan, you will receive a renewal commission. Certain carriers have a lifetime renewal commission while others have a commission cap after 5 or 6 years. It is important to check in with your client every year and make sure they are still in the best plan to provide what they need. This is true because clients needs as well as plan options change. The people who collect Social Security disability benefits also qualify to receive Medicare. The commissions are paid according to a percentage of the premium cost. This varies from plan to plan and carrier, area they are sold in as well as age of client. It is great that there are so many options available to clients.

You also need to become licensed in your state for you to be able to sell the types of insurance products you want; often, this requires taking insurance courses and passing exams. You can begin working as an independent insurance agent with a high school diploma; however, earning a degree related to business can provide you with useful business and sales skills. A good Medicare adviser will contact you for a review during the year — not just during the annual enrollment period, says Daniels. The best thing you can do is talk with your agent or a Personal Financial Planner about what is best for your situation, and if you find yourself questioning whether they are selling you something just to make money, then it might be a good idea to shop around and find other options before making a decision. Ashley Donohoe started writing professionally in about career, business and technology topics. The BLS expects all insurance sales agents to see an above-average growth of 10 percent for the period of through To maximize your prospects, you can sell medical insurance, which is in high demand. Life Insurance Agent vs Broker what their compensation agreement is with the insurance company what their compensation agreement is with the employer, or if they are independent If they have expenses to pay from the commission such as rent, staff and supplies. Life insurance companies understand this, so when a sale is made the commission may be perceived as high due to the fact that the model needs to account for this. In other words, most insurance agents are jacks of all trades and masters of none. Independent insurance agents have good job prospects, since it is more affordable for insurance companies to work with them. Resources 2 U. Since your business needs customers for it to thrive and make a profit, it is important to take initiative when building your client base. Approximately 18 percent of insurance agents are self-employed, whereas a smaller number of agents work for insurance carriers.

Why sell Medicare?

How are you compensated? How much independent insurance agents make varies by how many clients they have; what types of clients and how many insurance products their clients buy; and what the commission structure is like for the brokerages they work. According to Daniels, Medicare advisers are AHIP-certified and have additional training and certifications from each of the Medicare Advantage plans they represent. Other models of compensation may include higher salaries, and less commission percentage because of the arrangement they have made in their employment contract. Aadvantage of the models described above «commission heavy» or «salary heavy» this number varies greatly, and because it is a median, it insuranxe not showing you the high end of the more msdicare agents, or those who sell higher valued policies. In order to sell life insurance one must be licensed by the state they are practicing in. Some life insurance representatives may work as an agent medicaee one company or many that base their primary compensation on commission, these people may receive a lower base salary, and are expected to generate the bulk of their income from commission.

Medicare agent compensation

Here is all the information you need to know to help you find out how much the person selling you your life insurance policy is making, and a few tips to help you understand what the options are when it comes to choosing who to buy your life insurance.

People licensed to sell life insurance may hold several positions and compensation agreements that influence the amount of money they make. Many people who sell life insurance work on contract so commission may be their primary source of income. We get into the details and exact numbers. Other factors may impact how much money they make off your policy, but this gives you an idea of xdvantage reasons why one person may make more or less than.

Life insurance is highly competitive, and it is worth considering that for every policy sold, there were probably several that did not get sold, got rejected due to failing medical exams, or other reasons. Life insurance companies understand this, so when a sale is made the commission may be perceived as high due to the hkw that the model needs to account for. Your life insurance premium itself doesn’t change based on commission. The commission is the part of the premium the insurance company gives the representative for having made the sale, and then for providing good customer service to maintain the client through several years.

Some life insurance representatives may work as an agent for one company or many that base their primary compensation on commission, these people may receive a lower base salary, and are expected to generate the bulk of their income from commission.

Other models of compensation may include higher salaries, and less commission percentage because of the arrangement they have made in their employment contract.

If they are independent, they may even make all of the commission from the sale, however, if they work for a firm, they may have an agreement that makes it so that they are not receiving the whole commission due to the fact they have agreed to a salary instead. As you can see the answer to how much a person makes when they sell you a life insurance policy is not straightforward.

However, with the right information and questions, you can find. When you try and find out the average salary of a life insurance agent, because of the factors above, it is very hard to say. Keep in mind that this specifies a sales agent, and includes data from all insurance, not only life insurance. Because of the models described above «commission heavy» or «salary heavy» this number varies greatly, and because it is a median, it is not showing you the high end of the more established agents, or those who sell higher valued policies.

There are different kinds of life insurance policies. The type of life insurance policy will also impact the amount of money that will be paid out in commission. The larger longer term policies will usually pay more on commission. Whole life insurance lasts your entire life and it may build up cash value over time.

In all models, the payment structure for compensation adjusts for the circumstance, so you should not be paying more for life insurance if you go through a broker vs. The commissions they get are often adjusted for the circumstance and agreements they have signed. It all depends on which insurance company is offering coverage that best suits your scenario.

Brokers can often get you quotes with several companies to give you a chance to compare options. When you go through the carrier directly, they will only be offering you their products. If you are worried about added fees, ask the person quoting you if there are any added service fees and shop around for your options. This is one important reason that before you change a life insurance policy, you always want to be cautious that you are getting the right advice.

You can read more about this concern in our article about what you need to know before changing a life insurance policyor additional related issued this article about taking medical exams when you get a new life insurance policy.

At the end of the day, how much the person selling you your policy may be deviated by what they agreed to as a compensation agreement. Two people under two different compensation agreements selling you the same policy may walk away with different amounts of money as a result. What you probably want to know when you ask the question about how much money your life insurance agent or personal financial planner is making off the sale may be more about whether maoe should trust them to be providing you good advice, vs.

A life insurance agent agrnts broker or any financial planner should never be selling you something to profit for themselves. Yes, they need to make a living, but one piece of good news is that the sale of life insurance is regulated.

In order to sell life insurance one must be licensed by the state they are practicing in. The responsibility in the life insurance profession is to offer you products that fit your needs, so although life insurance can be profitable for someone selling life insurance as with any jobthe representative is supposed to be offering you products to fill your needsnot their own pockets. You should always feel comfortable with the person selling you life insurance and never feel pressured to advantzge something you are not sure of.

Sometimes the simplest way medixare find out how much your mjch insurance agent is making is to ask. The National Association of Personal Financial Advisors offers some great tips on finding ijsurance good representative. Here are some of the questions they recommend asking before you select a personal financial planner to help you:. Every situation is different. Every life insurance company is different. Overall, although it is interesting to know how much commission is being paid for your life insurance policy, you also need to consider:.

The best thing you can do is talk with your agent or a Personal Financial Planner about what is best for your situation, and if you find yourself questioning whether they are selling you something just to make money, then it might be a good idea to shop around and find other options before making insurannce decision.

It is your money and your life insurance, why deal with someone you don’t trust? Learn about cash surrender value. Insurance Life Insurance. By Od Araujo. Life Insurance Agent vs Broker what their compensation agreement is with the insurance company what their compensation agreement is with the employer, or if eo are independent If they have expenses to pay from the commission such as rent, staff and supplies. Subsequent year commissions may drop off medidare can be much lower.

The amount of commission paid will vary based on the agreement the agent has with the insurance company or with their employer if they are not contracted workers.

Many life insurance policy commission rates may take into consideration renewal or if the client keeps the policy over time, for example, if the client cancels the policy within the first few years, some companies may charge the commission back to the producer.

How are you compensated? Do you accept referral fees? Will you itemize the commissions you lnsurance get from the products you offer me? Continue Reading.

Income Potential for Agents

That means you can make a lot of money on Medicare commissions during AEP Compensation amounts for both types of plans increased from to For Puerto Rico and the U. Commissions for selling Medigap plans vary from carrier to carrier. It may sound confusing, but it works in your favor to partner with a great FMO that can connect you to many different carriers. You want to provide your clients with the plans that can offer the most benefit, and provide yourself with opportunities to earn. Maintaining strong client relationships is the key to maximizing your compensation.

After Initial Enrollment

People are much more willing to buy from someone they know and trust. Follow up with your clients and use a CRM to document every interaction in order to make sales tracking more efficient. You can sell additional items in your follow-up appointments depending on the time of year and what type of plan your client. Clients who have PDPs and Medigap plans can make changes to their plans or enroll in new plans whenever they want. Use that to your advantage in your follow-up calls and appointments. If your clients make changes to their insurance policies during your meetings, you get the commission. Your Medicare Advantage clients may have to wait for the AEP to make changes to their existing plans or enroll in new policies, but you still get the commission if clients make changes during your meetings. That makes strong client relationships and following up even more important. A year is enough time to forget about someone, and you want your clients to remember you and the excellent customer service you provide. At Senior Market Advisors, we give our agents the tools they need to succeed.

Thanks for sharing a good list of Health Insurance Companies & Medicare agents but choosing the one is the most complex to take because there are a large of medical agents & insurance companies. So I would like to suggest the most trusted & reliable medicare agents Houston. They help you discover the Medicare options that are good for your health and your wallet.

ReplyDelete