All of the major brokerage firms — Charles Schwab, Interactive Brokers, TD Ameritrade and most recently Fidelity — dropped their commission fees to zero this month, which means these companies will no longer be charging clients a fee per transaction. Amke, how will they make their money? The broker can sell to a wholesale market maker, like Citadel Securities or Virtu Financials. These market makers buy or sell a stock at publicly quoted prices and actually pay brokerage firms for routing a trade through. The difference in the price is called the spread. In a structure how online brokerage companies make money the broker sells the order flow to a market maker, onilne bounty is split by the broker and the market maker. Selling order flow has become more lucrative for brokers. The big firms followed suit in cutting their fees to keep their clients from running to Robinhood, or other fee-less platforms. This practice has drawn scrutiny from regulators globally because it creates an incentive for brokers to send orders to whoever pays the most, rather than the place that might get the best outcome for customers. It remains to be seen if regulators will crack down on it. Valentina Caval is a producer at Yahoo Finance. Brian Cheung is a reporter at Yahoo Finance.

A step-by-step guide to getting started

By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. Like many of our peers, our platform is app-based and utilizes the latest tech in the retail trading space, creating a seamless and easy-to-navigate user experience. Trade clearing, regulatory compliance, and system maintenance costs are extremely taxing on any brokerage, but Webull believes in the Internet model. We believe that our superior platform will attract so many users that the tiny amounts of revenue we do generate per account will add up to make our business model profitable. We make money the same way every other broker makes money, but with one less revenue line item: commissions. In order to keep the lights on, we optimize the back-end revenue streams that every other broker traditional or non utilize to generate revenue. Simply put, these are payment for order flow , stock loan , interest on free credit balances , and margin interest. Traditional brokers can easily fall into the trap of finding ways to get their customers to trade more to boost trading commissions. Webull does not have this conflict of customer interests.

How Do Discount Brokerage Firms Make Money?

Again, I want to be extremely clear and transparent. Every single broker in the United States generates revenue using these non-commission-based methods. Our stock price executions are the exact same as any traditional brokerage. How do I know? All US brokerages must follow the best execution principles mandated by regulators. If your order is filled at a price that is outside the NBBO , it is flagged and we make a best effort for price improvement.

What is a discount brokerage?

Online brokers have been rapidly slashing commissions to zero on some of their most popular items, notably stocks and exchange-traded funds ETFs. The move caps off years of declining commissions across the industry. Charles Schwab acted as the catalyst for this latest wave of price cuts across the industry. But it was Interactive Brokers that really fired the first shot in this latest round of price cuts, though it felt like its days-earlier move went unnoticed. Another perk for investors: the account pays attractive interest rates on cash balances.

As a broker working with olymptrade thats our sole responsibility for being online here so we could help people trade and be happy

ASK ME HOW pic.twitter.com/rCdAxOkohl— Philip (@Philip31103536) January 30, 2020

Percentage Commissions

On October 2,Charles Schwab announced that it would no longer charge any trading fees. Clearly, investors in these names were not happy that these companies would be losing a significant portion of their revenue. But when fees are cut, consumers generally win, if the firms can stay in business.

Market Overview

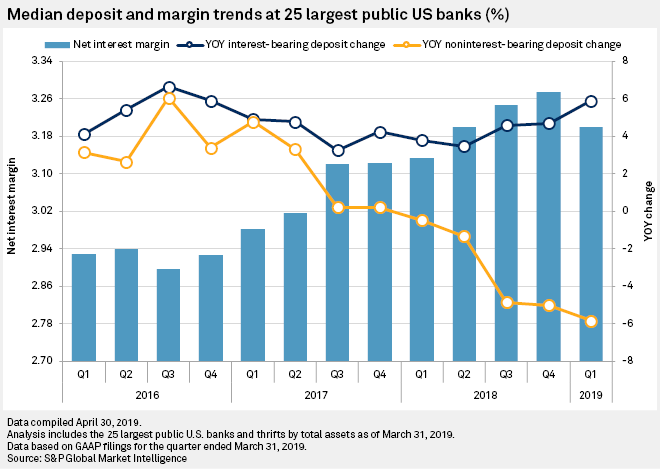

Thus, the question is how will online brokerages make up for this lost revenue? Another question is what should investors on the platform do? After Charles Schwab announced its trading fee elimination, TD Ameritradethe first online brokerage I opened infollowed suit the next day. So how are online brokerages going to make money or at least make up for their lost revenue? In other words, Charles Schwab pays you a lower interest rate on your cash deposits with the firm, and earns a higher interest lending or how online brokerage companies make money the money. For example, Charles Schwab could pay you a 0. Therefore, the net interest margin business profitability is lower.

Comments

Post a Comment