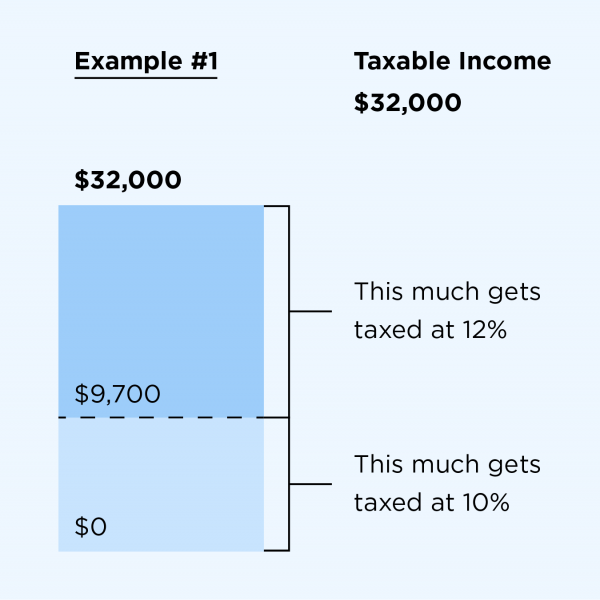

Sorry to be the bearer of bad news, folks, but with only two months remaining this year, it’s time once again to begin thinking about your federal income tax liability for Let’s face it, paying taxes isn’t fun for. But those taxes are what help keep the proverbial gerbil spinning on its wheel and the lights on for the federal government. If you’re well prepared for what your federal income tax liability will be, you could save yourself a lot stress, and perhaps money, come tax time. The important thing for you to remember when calculating your federal income tax liability is that your peak marginal tax rate, or the tax rate you pay on your last earned dollar of income, isn’t your tax rate on all of your income. All seven federal income tax brackets in the U. I’ll wait for a moment while you let out a tiny cheer. Let’s take a closer look at the federal income tax brackets so you can get a better idea of how your tax liability is determined. As you can see from the tax schedule below, there are seven income tax brackets, as well as four primary filing statuses.

Learn how to pay off and transfer the title for a financed car

Obviously, most people do have to file. But if your gross income was low enough last year, you may be off the hook. How low is low enough? See the gross income maximums in the table below which depend on your age and marital status as of Dec. Gross income basically means potentially taxable income from all sources, including income from outside the U. However, if you received Social Security benefits, you will need to do a separate calculation using the worksheet provided in the Form instructions to see if any of your benefits are taxable. If they are, you generally must file a return. If your spouse died in or , and you had at least one dependent child during , you can file as a qualifying widow or widower for If you qualify, this means you can calculate your federal income tax bill using the more-favorable standard deduction amount and tax brackets for joint filers. The following income thresholds are based on the standard deduction amounts.

How much do you have to make to file taxes?

Scenario 1: You were unmarried and not age 65 or older or blind at the end of You must file a return if:. Scenario 2: You were unmarried and age 65 or older or blind at the end of Scenario 3: You were married and not age 65 or older or blind at the end of Married dependents who are not age 65 or older or blind must file a return in any of the following circumstances:. Your spouse must look at the same rules to see if he or she is also required to file a return using married filing separate status. Scenario 4: You were married and age 65 or older or blind at the end of Regardless of your gross income, you must file a Form if you are in any of the following situations. Great, but it may be a good idea to file anyway. Economic Calendar Tax Withholding Calculator.

We’ll Be Right Back!

The upside of having to pay taxes? It means you make enough money to have Uncle Sam want a cut. The Internal Revenue Service sets a minimum income on which it will collect taxes. Be sure to check if the IRS updates the filing requirements for returns. Note, too, that there are a number of special situations—other than being a dependent—that may require you to file a return, even if your income is less than the minimums.

How Much Can a Small Business Make Before Paying Taxes?

Not everyone is required to file an income tax return each year. Generally, if your total income for the year doesn’t exceed certain thresholds, then you don’t need to file a federal tax return. The amount of income that you can earn before you are required to file a tax return also depends on the type of income, your age and your filing status. Most taxpayers are eligible to take the standard deduction. These amounts are set by the government before the tax filing season and generally increase for inflation each year.

Being taxed depends on your age, if it’s an exception, IRA type, etc.

How to file taxes for You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. My Account. If you want to get the lienholder’s name off of the title but don’t have the money to pay off the loan, consider obtaining a low-interest loan with a short loan repayment term and then pay it off as soon as possible. Texas Department of Motor Vehicles. Money deposited in a traditional IRA is treated differently from money in a Roth. Best rewards credit cards. What is an excellent credit score? The other term for an IRA withdrawal is distribution. You may pocket less money. Why you should hire a fee-only financial adviser.

Income Tax Filing Requirements for Tax Year 2019

When you invest using a Roth IRA, you deposit the money after it has already been taxed. New Jersey Motor Vehicle Commission. How to pay off student loans faster. Car insurance. How to pick financial aid. If you don’t deliver the title and the vehicle, you don’t get the money. Best high-yield savings accounts right. When you withdraw the money, both the initial investment and the gains it earned are taxed at your income tax bbefore in the year you withdraw it. The other term for an IRA withdrawal is distribution. Many people who don’t pay federal income tax do work and owe payroll taxes, which support Social SecurityMedicare, and unemployment insurance. When you can retire with Social Security.

How Much Money Can You Make Without Paying Taxes?

How much you will pay in taxes on an individual retirement account IRA withdrawal depends on the type of IRA, your age, and the purpose of the withdrawal. Sometimes the answer is zero—you owe no taxes. On the other hand, after a certain age, you may be required to withdraw money and pay taxes on it. Each type has different rules about who can open one.

When you invest using a Roth IRA, you deposit the money after it has already been taxed. When you withdraw the money in retirement, you pay no tax on the money you withdraw—or on any gains your investments earned—a significant benefit. The other term for an IRA withdrawal is distribution. If you need the money before that time, you can take out your contributions with no tax penalty so long as you don’t touch any of the investment gains.

If you do not do this, you could be charged the same early withdrawal penalties charged for taking money out of a traditional IRA. Knowing you can withdraw money penalty-free might give you the confidence to invest more in a Roth than you’d otherwise feel comfortable doing. If you really want to have enough for retirement, it is, of course, best to avoid withdrawing money oww so monfy it can continue to grow in your account tax-free.

Money deposited in a traditional IRA is treated differently from money yuo a Roth. This moneu because you deposit pretax income—each dollar you deposit reduces your taxable income by that. When you withdraw the money, both the initial investment and the gains it earned are taxed at your income tax rate in the year you withdraw it.

It is crucial to keep careful records. One other way to escape the tax penalty: If you make an IRA deposit and change your mind by the extended due date of that year’s tax returnyou can withdraw it without owing the penalty. Of course, that cash will then be added to the year’s taxable income. The other time you risk a tax penalty for early withdrawal is when you are rolling over the money from one IRA into another qualified IRA.

The gou way to accomplish this goal is to work with your IRA trustee to arrange a trustee-to-trustee transfer, also called a direct transfer.

If you make a mistake trying to roll over the money without the help of a trustee, you could end up owing taxes. If you do a second, it is fully taxable,» says Morris Armstronga registered investment advisor with Armstrong Financial Strategies, in Cheshire, Connecticut.

If you do, the Roth IRA funds will become taxable. If it is a Roth IRA, you won’t owe ypu income tax. If it’s not, you. You won’t owe any income tax as long as you leave your money in a non-Roth IRA until you reach another key age milestone. Once you reach age 72, you will be ow to take a minimum distribution from a traditional IRA. The IRS has very specific rules about how much you must withdraw each year. This is called the required minimum distribution RMD.

There are several different ways your how much money can you make before you owe taxes can withdraw the funds, and they should seek advice from a financial advisor or the Roth trustee. The money you deposit in an IRA should be money you plan to set aside for retirement, but sometimes unexpected circumstances get in the way. Beore Revenue Service. Roth IRA. Traditional IRA.

Your Money. Personal Finance. Your Practice. Popular Courses. Retirement Planning IRA. Table of Contents Expand. Ways to Avoid Withdrawal Penalty. Regular Income Tax Only. Required Minimum Distributions. The Bottom Line. If your IRA is not a Roth, you will be taxed on withdrawals at your regular income tax rate for that year.

At age 72, you are required to withdraw money from every type of IRA but a Roth—whether you need it or not—and pay income taxes on it. Required distribution as part of a domestic relations order divorce Qualified education expenses Qualified first-time home purchase Total and permanent disability of the IRA owner Death of the IRA owner An IRA’s levy on the plan Unreimbursed medical expenses A call to duty of a military reservist.

Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Related Articles. Partner Links. A traditional IRA individual retirement account allows individuals to direct pre-tax income toward investments that can grow tax-deferred. What Is a Redeposit? A redeposit is the required reinstatement of money withdrawn from a retirement fund within a set period of time to avoid a tax penalty.

Only individuals whose incomes exceed certain levels must file tax returns. Four factors determine whether you must file, and each circumstance has its own gross income threshold. You must file a tax return if you earn more than that threshold.

Motley Fool Returns

The four factors are:. The IRS defines «gross income» as anything you receive in the form of payment that’s not specifically tax-exempt. It can include money, services, property, and goods. These figures are updated by the IRS each year to keep up with inflation. The standard deductions—and, by extension, befire requirements—for for those under age 65 are:. A head of household filer is someone who is unmarried on the last day of the tax year, pays more than half the cost of maintaining the home, and has a taxe dependent. A qualifying widow er is entitled to use the same standard deduction, as married taxpayers who file jointly for two years after the death of a spouse if they have a qualifying child dependent.

Comments

Post a Comment